If you are a futures trader with multiple trading accounts (IRA, Individual, etc), have trade authorization over other accounts and/or a Commodity Trading Adviser (CTA) in need of block trade allocation, please consider OEC Trader. You no longer need to rely on back office support as OEC Trader performs the block account allocations in real time, saving you hours during the month managing blocks and other admin tasks related to trade allocations. The software also integrates with DMAXX in case you are a Commodity Trading Adviser (CTA).

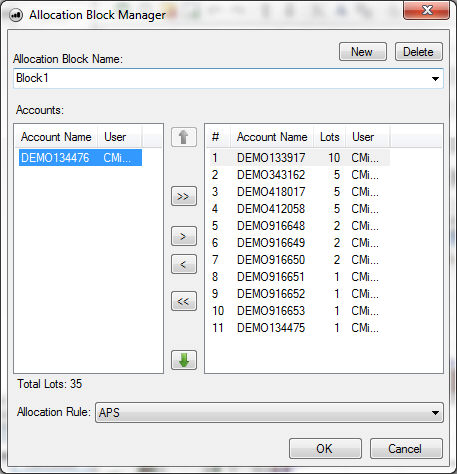

OEC Trader has a built in mechanism that allows you to determine pre-allocation based on the specific criteria that you select for your futures trading account.

- Lowest Account Lowest Price – The Allocation Rule that designates the OEC Trader to fill the lot request of the account name with the Lowest Account Sequence number (a system generated identification number) in the allocation block list with the Lowest Price lots.

- Lowest Account Highest – Price The Allocation Rule that designates the OEC Trader to fill the lot request of the account name with the Lowest Account] Sequence number (a system generated identification number) in the allocation block list with the Highest Price lots.

- Highest Account Highest Price -The Allocation Rule that designates the OEC Trader to fill the lot request of the account name with the Highest Account Sequence number (a system generated identification number) in the allocation block list with the Highest Price lots.

- Highest Account Lowest Price – The Allocation Rule that designates the OEC Trader to fill the lot request of the account name with the Highest Account Sequence number (a system generated identification number) in the allocation block list with the Lowest Price lots.

- APS – Average Price System across all fills

Additional features of OEC Trader:

- One login for the entire series of accounts you control

- See allocation in real time

- DOM Display of all your order, stops and targets

- Set up multiple allocation accounts based on the futures market you trade.

If you wish to test the Block Account Allocation Manager, please request a FREE OEC Trader DEMO and email us at general@optimusfutures.com with the subject of “OEC Allocation Manager” so we can enable it. Or you may call us at 1-800-771-6748 local 561-367-8686 for more information on how to get started.

Trading futures and options involves substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results. The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders.